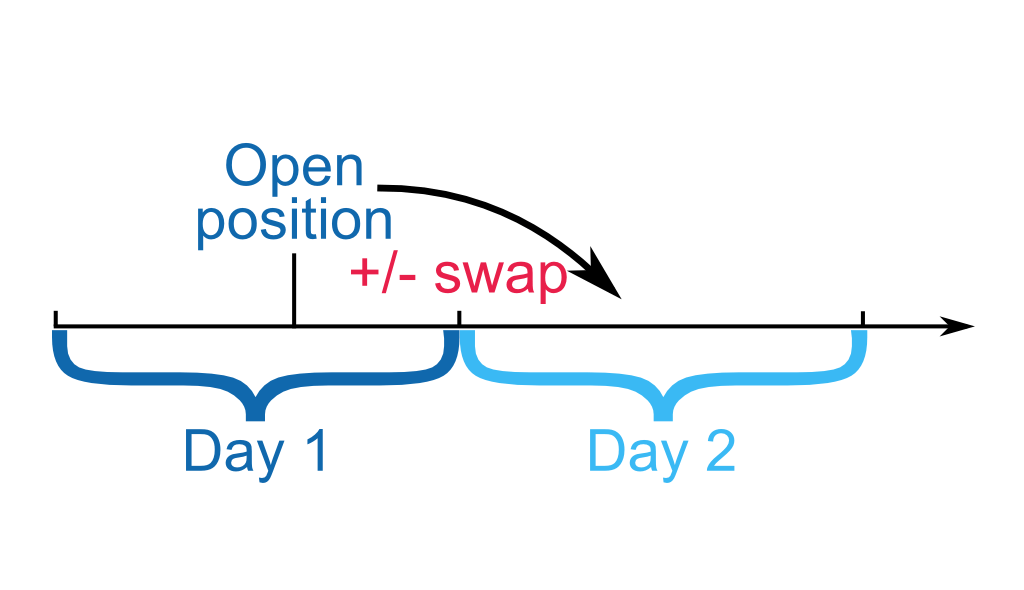

A swap in forex refers to the interest that you either earn or pay for a trade that you keep open overnight. There are two types of swaps: Swap long (used for keeping long positions open overnight) and Swap short (used for keeping short positions open overnight). They are expressed in pips per lot, and vary depending on the financial instrument 26/03/ · As we have discovered in this guide to what is a swap in Forex, ehen traders buy a currency pair and leave the position open overnight, they use a long swap. And if they sell the pair and leave the position overnight, they use a short swap 09/02/ · What is Swap in Forex? A swap, which is also known as the rollover fee, is the cost you need to pay if you keep a position open overnight. Basically, a swap is the interest rate differential between the currencies in the pair that you are trading. The interest rate for each currency is determined by the country’s central bank

FX swap trading - What happens when you leave positions open overnight?

Traders can see in statements overnight rollover fees. Sometimes, depending on the main difference in the interest rates between the currencies in a pair, this fee will be paid what is swap long in forex you.

Forex swap fee or forex rollover represents the interest traders can earn or pay on positions held overnight on the Forex market. A swap long fee will be applied when traders keep long positions open overnight, and swap short will be applied when traders keep short positions open overnight.

You may be aware that there is money to be made in forex, but you may not know how what is swap long in forex go about it as a beginner. You may have come across terms like rollover fee or swap in forex trading. But it is quite possible that you may not be fully aware of the same because of a lack of information and knowledge, what is swap long in forex.

Further, if you are one of those who are into scaling, you may have never come across such types of fees. Nonetheless, it would not be a bad idea for you to have a reasonably good understanding that could answer the question of how to earn a swap in forex. We are sure the following few lines may help readers find the correct answer to the above question.

It will help them to have a more recent and more informed perspective about forex trading. It will perhaps help them succeed in forex trading in the medium and long-term view.

Positive Swaps in forex represent a positive difference between the interest charged and received, and then traders receive the difference in the trading account. Negative Swaps in forex represent a negative difference between the interest charged and received, and then the difference will be taken out from the trading account.

Since swap is the difference in interest, it can work both ways, what is swap long in forex. You could either be paid for the difference in interest rates for such overnight trading. On the other hand, you could be charged an interest differential amount. This would be dependent on the currency pair that you are trading during such a swap situation. When you decide to trade on margin, what is swap long in forex will end up making money on the interest.

This will be for long positions after squaring off the interest payable on the various short trades. On the other hand, if you have decided to take only trades that will lead to a positive interest as far as your account is concerned, you are considered a carry trader. What is swap long and short forex? Swap long and swap short are swap fee types. To calculate the swap rate for 1 lot and 1.

Hotforex swap value is changing every day. However, Hotforex offers a special Hotforex swap calculator where all traders can calculate swaps for their accounts. When you are into swap trading in forex trading, you need not worry too much about losses. However, this will what is swap long in forex possible only when you keep your trade as short as possible. It would be advisable not to keep the trade longer than a week or ideally for around five days. It would also not be good to keep the trade open during the weekend because violent volatilities often happen when trading opens after the weekend.

Successful traders who use the swap mode try and use this facility twice a week, and they believe that it could give more profits. Hazarding guesswork during the beginning of the next week is best avoided. Islamic accounts usually do not offer rollover fees; they are swap-free. Usually, what is swap long in forex, this is because of religious purposes because swap is interesting, and every kind of loan is prohibited haram in the Islamic world, what is swap long in forex. Forex broker without swap Forex brokers that offer swap-free accounts are: Hotforex swap free account Avatrade swap-free account ICMarkets Islamic swap-free account.

Bounce back strategy could also be used when using what is swap long in forex as an alternative, what is swap long in forex. Many what is swap long in forex traders have used it on Monday and Tuesdays. However, the bounce-back strategy should not be kept open for long periods of time, and it should be closed by Friday mornings, what is swap long in forex.

It would be better to get out the swap option by Friday, even if there is a loss situation. Keeping it open what is swap long in forex Monday next should be avoided as much as possible. You have to remember that if the carry forward is positive, you stand to gain money into your account. If it is negative, you have to square off the difference, which will be taken from your account.

This is auto-calculated as far as brokers are concerned. The swap fee for major currencies is not very high, and in fact, the fee for gold in such situations could be much higher. However, it could vary a lot, and as somebody who is just getting started, you should not bother too much about the possible variations. However, if you are serious about it and would like to get into long swing trades, and if you are keen on holding onto the trades for a few weeks at one go, you must put effort into research.

You must visit a few sites and use calculators to be updated about the possible outcomes using the swap option. Many new traders often ask if it is possible to avoid swap fess in a forex transaction. To get an answer to this, you need to look at it from another angle.

You could look for trading in trends that are beneficial to you, even if it means carrying your account forward to the next round. You could choose to trade intraday if you close your trades latest by 5 PM EST. This is the time when the New York Session comes to an end. This is considered to be the easiest way to do things and to avoid paying the swap fee. It works fine, but it might require some bit of practice and handholding before you can do it perfectly.

It is evident from the above that there are some pros and cons of using the swap mode of forex transaction by paying the requisite fees. Though there are ways to avoid them, you should not bother about it until you are comfortable with the demo versions. However, it would help if you did not allow swap trading to take over swing trading completely. It all depends on your style of trading. If you can do it properly, it is obvious that your wins will be much more than the fees you may end up paying.

You also can have the luxury of looking at many brokers if you believe that your spread and other expenses are smaller than other brokers. You should know how to spread the risk across. However, at the same time, some trade does take a lot of time. It may not be able to come out with a single strategy, and you may have to do quite a bit of permutation and combinations before you can come out with something new and successful.

Home Choose a broker Brokers Rating PAMM Investment Affiliate Contact About us. Table of Contents. Author Recent Posts. Trader since Currently work for several prop trading companies, what is swap long in forex. Latest posts by Fxigor see all.

What is the Velocity of Money? Problems in Capital Market! Related posts: Swap Points — Swap rate calculation forex example Interest Rate Swap Arbitrage Equity Swap vs CFD The Best Islamic Forex Broker Is Forex Trading Haram or Halal in Islam? How Long Can You Hold a Forex Position? How to Open Hotforex Live Account? Hotforex South Africa Review What Does Equity Mean in Forex? Trade gold and silver. Visit the broker's page and start trading high liquidity spot metals - the most traded instruments in the world.

Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates Key Economic Indicators For a Country The Best Forex Brokers Ratings List Top Forex brokers by Alexa Traffic Rank Free Forex Account Without Deposit in Brokers That Accept PayPal Deposits What is PAMM in Forex? Are PAMM Accounts Safe? Stock Exchange Trading Hours. Main navigation: Home About us Forex brokers reviews MT4 EA Education Privacy Policy Risk Disclaimer Contact us.

Forex social network RSS Twitter FxIgor Youtube Channel Sign Up. Get newsletter. Spanish language — Hindi Language.

What is Swap in Forex \u0026 How to Calculate It?

, time: 6:37What is Swap Fee in Forex? - Forex Education

24/05/ · There are two types of swaps. The first swap is a long swap. This relates to keeping long positions open overnight. With the long swap, you will likely earn interest on your positions. The other type of swap is a short swap. This one keeps short positions overnight. As you will earn interest on the long positions, you will have to pay interest when you have a short position. So how do you make Estimated Reading Time: 6 mins 29/09/ · The Forex Swap Explained. The Forex swap, or Forex rollover, is a type of interest charged on positions held overnight on the Forex market. A similar swap is also charged on Contracts For Difference (CFDs). The charge is applied to the nominal value of an open trading position blogger.comted Reading Time: 9 mins 09/02/ · What is Swap in Forex? A swap, which is also known as the rollover fee, is the cost you need to pay if you keep a position open overnight. Basically, a swap is the interest rate differential between the currencies in the pair that you are trading. The interest rate for each currency is determined by the country’s central bank

No comments:

Post a Comment