11/08/ · AUD/USD ended up being the most un-unpredictable currency pair. Concerning the cross rates, GBP/NZD, GBP/AUD, GBP/computer aided design, and GBP/JPY are the pairs with the most noteworthy unpredictability. Every one of them proceed onward normal for in excess of focuses every day. Which currency Pair is Most Profitable in forex 28 rows · 22/12/ · Among the Major pairs and in general – EURUSD; Among the Minor pairs – EURJPY; Among the Exotic Estimated Reading Time: 5 mins 11/12/ · So, the most liquid currency pair is EUR/USD, which accounts for 28% of the total transaction volume in the Forex market. The second most liquid forex pair is USD/JPY, with a share of 13%. The third most liquid pair is GBP/USD (11%).Estimated Reading Time: 3 mins

The Most Liquid Forex Currency Pairs in - Pie Chart | FXSSI - Forex Sentiment Board

CFDs are complex instruments. You can lose your money rapidly due to leverage. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. View more search results. Forex is the largest and most volatile market in the world with hundreds of currency combinations to choose from.

To simplify things, here are the ten most traded forex pairs on the market. The figures in this article are from the Bank of International Settlements BIS triennial survey, which was last taken in April Currencies are always traded in pairs because when you buy or sell one currency, you automatically sell or buy another. In every currency pair, there is a base currency and a quote currency — the base currency appears first, and the quote currency is to the right of it.

The price displayed for a currency pair represents the amount of the quote currency you will need to spend in order to purchase one unit of the base currency. If the quote price was 1. Broadly speaking, forex pairs can be separated into three categories. These are the majors, the commodity currencies, and the cross currencies:. Liquidity and tight spreads are enticing for traders because they mean that large trades can be made with little impact on the market.

This is because the currency with the higher interest rates will generally be in higher demand because higher interest rates give a better return on their initial investment.

If for instance, the ECB had set higher interest rates than the Fed, it is likely that the euro would appreciate relative to the dollar. It is the second most traded forex pair on the market, representing Much in the same way as the Fed and ECB, the Bank of Japan BoJ sets the interest rates for the Japanese forex pairs with most volume which, forex pairs with most volume, in turn, affects the value of the yen relative to the US dollar.

The currencies in this pair are the pound sterling and the US dollar. If the British economy is growing at a faster rate than that of America, it is likely the pound will strengthen against the dollar. However, if the American economy is doing better than the British economy, the reverse is true. It made up 5. A slump in the value of these commodities on the world market would likely cause a reciprocal slump in the value of the Australian dollar.

For example, forex pairs with most volume, if American interest rates are low, USD would probably weaken against AUD and it would cost more US dollars to buy one Australian dollar. Since oil is priced in US dollars on the world markets, Canada can earn a large supply of US dollars through its oil exports.

As such, if the price of oil rises, it is likely that the value of the Canadian dollar will strengthen compared to the US dollar. It is a general rule that the US dollar normally weakens when the price of oil increases, because if the dollar is weaker, more US dollars must be converted into other currencies to buy the same amount of oil as before.

In turn, forex pairs with most volume, expensive oil means that the Canadian dollar will likely strengthen due to the close ties between the Canadian dollar and the price of oil. The yuan has largely been decreasing relative to the US dollar since the start of the US-China trade war. Yuan is referred to as CNY only when it is traded in the onshore Chinese market. CNH has traditionally not been as tightly controlled as CNY by the Chinese government, which means it can be more volatile. This volatility can make it a better choice for speculative trading.

Traders should keep an eye on the US-China trade war as any developments are likely to affect the price of this currency pair. As a result, traders often turn to CHF during times of increasing market volatility, but the Swiss franc will typically see less interest from traders during times of greater market stability. During times of increased volatility, it is likely the price of this pair would drop as CHF strengthens against the USD after experiencing increased investment.

Since CHF is turned to primarily during times of economic volatility or as a safe haven, it is not as actively traded as the six forex pairs with most volume currency pairs on this list.

The rise could have been due to the Hong Kong protests which dominated The protests were a result of the attempted implementation of the Fugitive Offenders amendment bill, as well as allegations of police brutality against the people of Hong Kong. In part, this could be because the increased media buzz caused many traders and speculators to focus their attention on the Hong Kong dollar, forex pairs with most volume the assumption that its value would be affected by any news from the city.

The value of the Hong Kong dollar is pegged to the US dollar in a unique system known as a linked exchanged rate. This is because EUR and GBP have had a historical link given the proximity of the UK to Europe and the subsequent strong trade ties between these two economies.

As with the other currency pairs on this list, traders should keep an eye on any ECB and BoE announcements which could affect the exchange rates of the euro and the pound, which would increase volatility further.

In recent years, this currency pair has fluctuated in price quite unpredictably — primarily due to the uncertainty surrounding Brexit. The high level of volatility can be attractive to traders, but it is important to have forex pairs with most volume risk management strategy in place before opening a position in a volatile market. This forex pair made up 1. The South Korean economy has grown during the turn of this century to become the fourth largest in Asia and the eleventh in the world as of November Economic growth in South Korea has been so impressive — especially since the end of the Korean war in — that people often refer to it as the Miracle on the Han River.

This growth is now being capitalised on, and South Korea enjoys membership of the United Nations, the Organisation for Economic Co-operation and Development OECD and the G20, forex pairs with most volume, making the country and its currency an exciting opportunity for many market participants.

Traders should take a number of factors into consideration before choosing a currency pair to trade, and they should carry out their own technical and fundamental analysis to assess whether the currency pair is a viable trading option at that particular point in time, depending on announcements from central banks or ongoing trade disputes. This information has been prepared by IG, forex pairs with most volume, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information.

Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to forex pairs with most volume clients.

Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. Practice makes perfect, forex pairs with most volume. Compare features. en ig. IG Terms and agreements Privacy How to fund Cookies About IG. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. CFD Accounts provided by IG International Limited. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority.

IG provides an execution-only service. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or forex pairs with most volume for transaction in any financial instrument. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction forex pairs with most volume such distribution or use would be contrary to local law or regulation, forex pairs with most volume.

IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. IG International Limited receives services from other members of the IG Group including IG Markets Limited. Careers IG Group, forex pairs with most volume. More from IG Personal Community Academy Help, forex pairs with most volume. Inbox Community Academy Help. Log in Create live account.

My account My IG Inbox Community Academy Help Personal Logout. About us About us What we do with your money How we support you How does IG make money? CFD trading CFD trading What is CFD trading and how does it work? How to trade CFDs What are the benefits of trading CFDs? Charges and margins Volume-based rebates CFD account details Reduced minimums Markets to trade Markets to trade Forex Shares Commodities Futures trading Spot trading Cryptocurrencies Other markets Weekend trading Volatility trading Knock-Outs trading Market data Trading platforms Trading platforms Mobile trading Trading signals Trading alerts Algorithmic trading APIs ProRealTime MetaTrader 4 Compare platforms Learn to trade Learn to trade Managing your risk Trade analytics tool News and trade ideas Strategy and planning Financial events Trading psychology podcast series Economic calendar Glossary of trading terms.

Related search: Market Data. Market Forex pairs with most volume Type of market. Learn to trade Strategy and planning Top 10 most traded currency pairs. Top 10 most traded currency pairs. Forex Commodities United States dollar Currency Euro Pound sterling. Writer. What are the most traded forex pairs in the world?

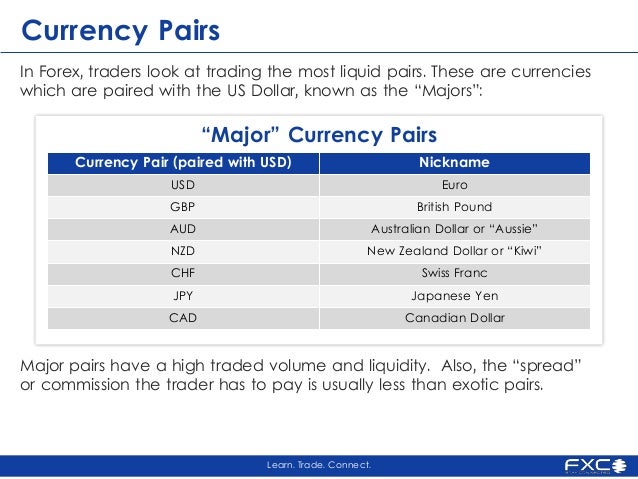

Forex pairs explained Currencies are always traded in pairs because when you buy or sell one currency, you automatically sell or buy another. Different types of forex pairs Broadly speaking, forex pairs can be separated into three categories. These are the majors, the commodity currencies, and the cross currencies: Major currencies are those that are most traded on the markets. Explore the markets with forex pairs with most volume free course Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course.

Try IG Academy, forex pairs with most volume. Turn knowledge into success Practice makes perfect. Try it out. Ready to trade forex? Put the lessons in this article to use in a live account, forex pairs with most volume.

Upgrading is quick and simple, forex pairs with most volume. Trade over 80 major and niche currency pairs Protect your capital with risk management tools Analyse and deal seamlessly on smart, fast charts.

5 FOREX PAIRS THAT WILL MAKE YOU RICH [TRADING HACK 2020]

, time: 6:57Top 10 Most Traded Currency Pairs | IG EN

11/12/ · So, the most liquid currency pair is EUR/USD, which accounts for 28% of the total transaction volume in the Forex market. The second most liquid forex pair is USD/JPY, with a share of 13%. The third most liquid pair is GBP/USD (11%).Estimated Reading Time: 3 mins 11/08/ · AUD/USD ended up being the most un-unpredictable currency pair. Concerning the cross rates, GBP/NZD, GBP/AUD, GBP/computer aided design, and GBP/JPY are the pairs with the most noteworthy unpredictability. Every one of them proceed onward normal for in excess of focuses every day. Which currency Pair is Most Profitable in forex 28 rows · 22/12/ · Among the Major pairs and in general – EURUSD; Among the Minor pairs – EURJPY; Among the Exotic Estimated Reading Time: 5 mins

No comments:

Post a Comment